In India, the army, paramilitary forces, police personnel, and officers are exempted from paying a toll tax at the toll plazas. The Government of India has made a separate FASTag for them, which the defense personnel can affix to their motor vehicle. The toll plaza will scan their FASTag card and open the toll barrier without deducting any money from their account. These tags are technically known as ‘zero transaction’ tags.

Defense sector employees are exempt from national highway tolls under the Indian Toll (Army and Air Force) Act 1901. The Central Government has also included the state’s Armed and Paramilitary Force personnel in the exemption FASTag list category. Vehicles transporting police, paramilitary, and state and central armed forces are exempt from paying toll tax.

The Objectives of Free FASTag for Defence Personnel

With the introduction of these tags, the government is trying to end the menace of everyday commuters who avoid paying toll tax and claim to be in the exempted category.

This is also aimed at keeping records of all the free transactions across the national highway network. The free FASTags are linked to the office of the exempted category individual and not to individuals as such.

Some of the key features of the free FASTag for defense personal

- The National Highways Authority of India (NHAI) has clarified that exemption from paying toll charges on national highways to defense personnel is available only when “on duty.”

- Officers of 24 zones of NLAI are responsible for ensuring the smooth flow of this initiative throughout the country.

- No exemption will be given if they travel in a private vehicle while “off duty.” The FASTag exemption is not available for retired defense personnel.

- To receive free FASTag service, Jawans and officers must apply online on the Indian Highway Management Company Limited (IHMCL) website. After a thorough examination, FASTags will be issued to applicants.

- Getting a FASTag from the FASTag issuing banks and agencies will not provide this facility.

- Defense sector employees are also exempted from paying fees for the application.

List of Exempted Vehicles

| Exempted Category Code | Exempted Category Description |

|---|---|

| 1 | The President of India |

| 2 | The Vice-President of India |

| 3 | The Prime Minister of India |

| 4 | The Governor of a State |

| 5 | The Chief Justice of India |

| 6 | The Speaker of the House of People |

| 7 | The Cabinet Minister of the Union |

| 8 | The Chief Minister of a State |

| 9 | The Judge of the Supreme Court |

| 10 | The Minister of State of the Union |

| 11 | The Lieutenant Governor of a Union territory |

| 12 | The Chief of Staff holding the rank of full General or equivalent rank |

| 13 | The Chairman of the Legislative Council of a State |

| 14 | The Speaker of the Legislative Assembly of a State |

| 15 | The Chief Justice of a High Court |

| 16 | The Judge of a High Court |

| 17 | The Member of Parliament |

| 18 | The Army Commander of Vice-Chief of Army Staff and equivalent in other services |

| 19 | The Chief Secretary to a State Government within the concerned State |

| 20 | The Secretary to the Government of India |

| 21 | The Secretary, Council of States |

| 22 | The Secretary, House of People |

| 23 | The Foreign dignitary on State visit |

| 24 | The Member of legislative Assembly / Council – other identity card issued by the concerned Legislature |

| 25 | The awardee of Pram Vir Chakra, Ashok Chakra, Maha Vir Chakra, Kirti Chakra, Vir Chakra and Shaurya Chakra photo identity card duly authenticated |

| 27 | The Central and State armed forces in uniform, including Paramilitary forces and police |

| 28 | Used as an ambulance and |

| 29 | An Executive Magistrate |

| 30 | The fire-fighting Department or organization |

| 31 | The NHAI or any other Government organization using such Vehicle used in Operation NHAI Survey, Construction and maintenance |

| 32 | Used as a funeral van. |

| 33 | Mechanical vehicles are specially designed and constructed for people suffering from physical disabilities or registered with ownership type DIVYANGJAN under the Motor Vehicles Act, 1988. |

| 34 | The Foreign dignitary on a State visit |

Documents required to apply for exemption FASTag

- Duly filled and signed Application form

- RC of the vehicle

- Applicant’s identity proof (Aadhaar, PAN card, Passport, etc.)

- Waiver proof/proof of exemption (service identification card)

The process to Apply Exempted FASTag

Below are the steps that you can follow to apply for FASTag exemption online.

- First, visit the Indian Highways Management Company Limited (IHMCL) website:https://ihmcl.co.in/

- Click on the Button: Exempted FASTag Portal

- You will be redirected to a new link: https://exemptedfastag.nhai.org/Exemptedfastag/

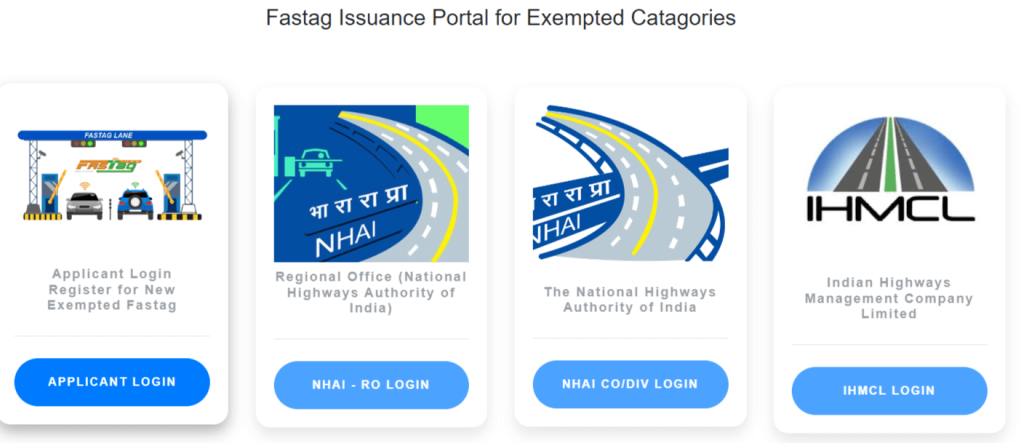

- Click on the First Option, i.e., Application Login register for new Exempted Fastag.

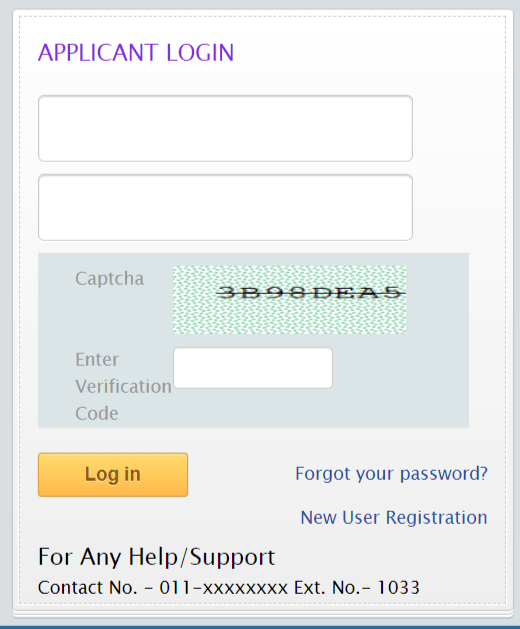

- If you are already registered, enter your USERNAME and PASSWORD.

- If not, please click on New User Registration.

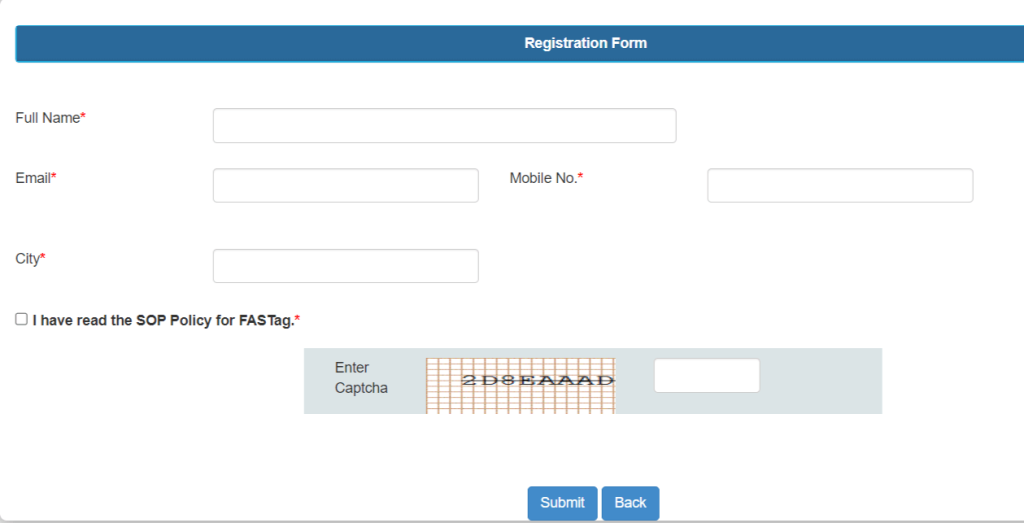

- Please enter your full name, email, mobile number, city, and the password code shown in the image.

- Your login ID and password will be sent to your registered email address.

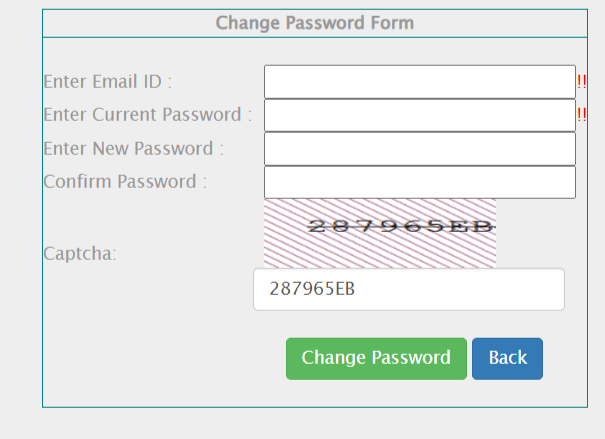

- You can log in to the account using this ID and password. After logging in, you must Change the password to your email ID.

- Enter Enter Email ID, Enter Current Password (sent to your Email), Enter New Password, Confirm Password, Captcha

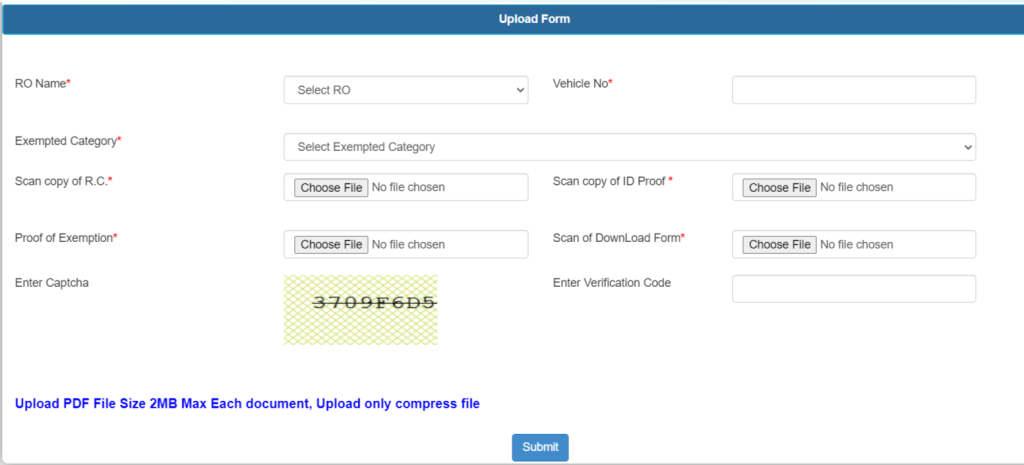

- Enter following :

- RO Name*

- Select RO

- Vehicle No*

- Exempted Category*

- Select Exempted Category

- Scan copy of R.C.

- Scan copy of ID Proof

- Proof of Exemption

- Enter Captcha

- Enter Verification Code

NOTE: Upload PDF File Size 2MB Max Each document, Upload only compress file

- Submit the application and receive a confirmation email on your registered email ID. You will also get the application number, which you can use to check the status. Documents are verified post-submission; any deficiencies will be informed via email. Once verified and approved, NHAI will issue the exempted FASTag through a call using the OTP sent to your mobile number.

What is the post-application process for exempted FASTag?

Follow the steps below to check after completing the application process for your exempted FASTag.

- First, you must log in to the IHMCL web portal using your user ID and password.

- After that, if there are any pending formalities left, you will have to submit your required documents to initiate the process.

- Once the application is approved, you will receive an approval email and will be issued with an exempted FASTag.

- After that, you are required to collect your exempted FASTag sticker from your respective regional office of NHAI.

Exempted FASTag Support contact details

If you have any questions or queries concerning the exempted FASTag, you can write to exemptedFASTag@ihmcl.com.

Frequently Asked Questions

What is the validity of an exempted/free FASTag service?

An exempted FAS tag for government vehicles transporting police, paramilitary, and state and central armed forces is valid for up to 5 years, while the validity for private cars is only one year.

Are vehicles exempted from paying toll tax mandatory to affix a FASTag sticker?

Yes, it is mandatory for vehicles exempt from paying toll tax to affix the FASTag sticker on their motor vehicle for scanning purposes.

What is the price to apply for an exempted FASTag?

As per the National Highways (NH) Fee Rule 2008, applicants can apply for and receive exempted FASTags free of charge.

Can I get an exempted FASTag from any FASTag issuing banks/agencies?

No, only an agency authorized by the NHAI (e.g., the Indian Highways Management Company Limited (IHMCL) is allowed to issue exempted FASTags in the country.

Related Article